“This has been the most predicted potential recession in memory,” said Federal Reserve Bank of Richmond President Tom Barkin way back in January. Still, the United States managed to avoid a recession. Things weren’t great last year: Inflation hit a 40-year peak, gas prices were elevated, consumer sentiment plunged and markets fell by 20%. A hard landing is coming, he cautioned, and “it’s just naive not to be open-minded to something really, really bad happening.”įor more than a year CEOs, economists, analysts and their kind have been warning of an imminent economic downturn, The economy, meanwhile, has remained relatively resilient through it all. Given the risks that lie ahead, he told Bloomberg news, “I would take a mild recession happily.”īillionaire investor Stan Druckenmiller didn’t mince his words this week at the Sohn Investment Conference. JPMorgan CEO Jamie Dimon warned on Thursday of great economic danger lurking just over the horizon. That time frame begins less than three weeks from now.

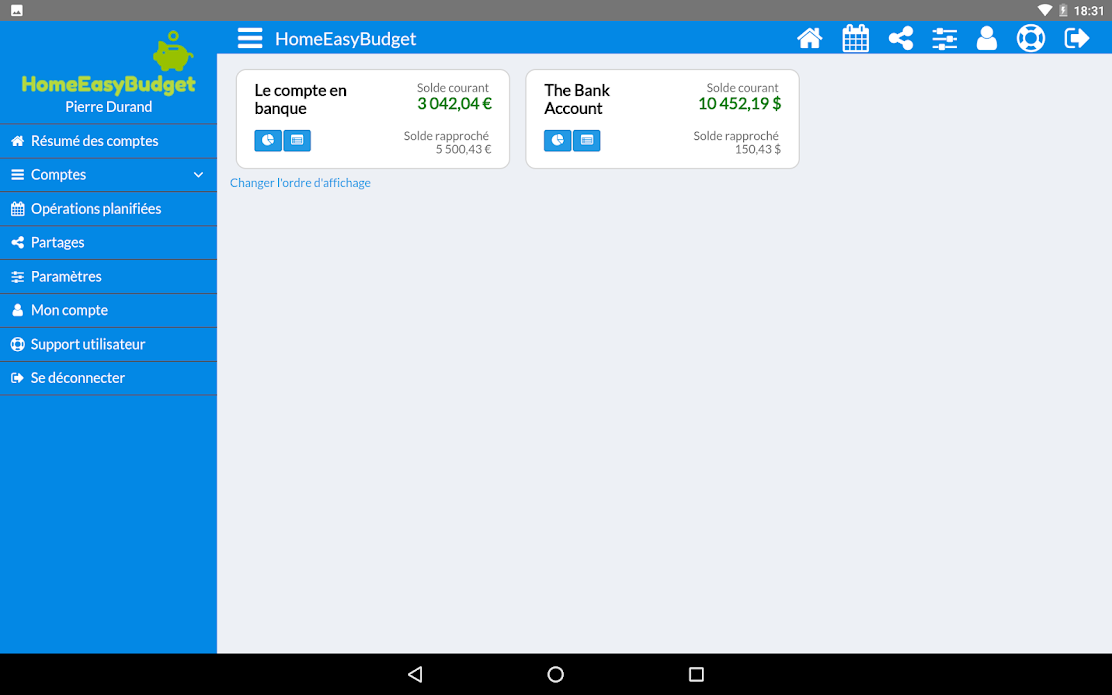

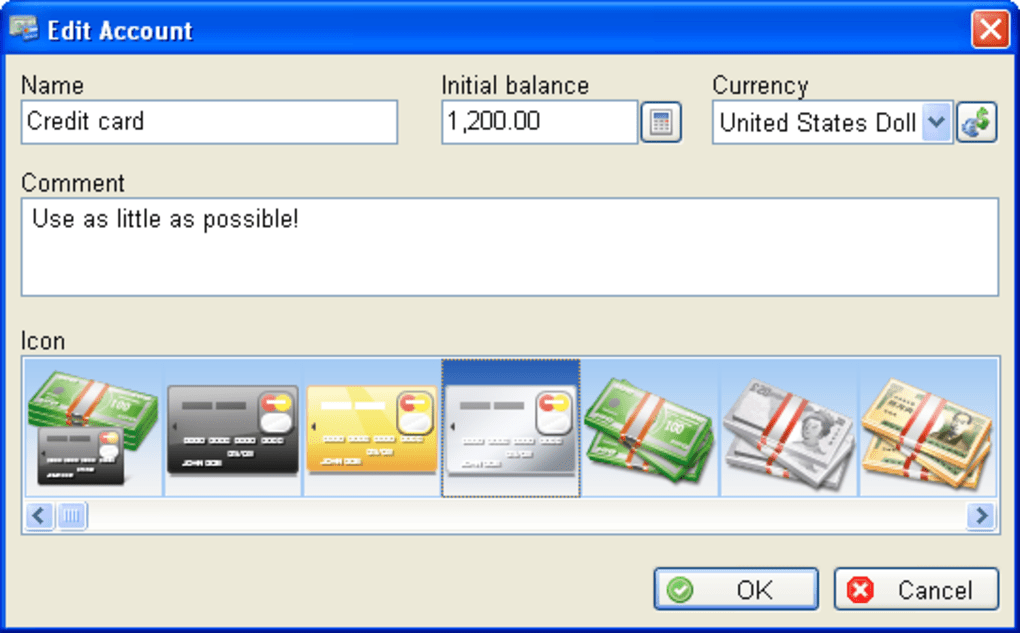

A US recession is coming, they say, in the second half of 2023. AlternativesĪpp-only banks such as Starling Bank and Monzo combine the logistics of a current account with the addition of handy budgeting features such as personalised spending analytics, the ability to separate your money into savings pots or spaces and automatic saving with spare change roundups as you spend.Economic experts are once again ringing the alarm bells over an imminent downturn. Monthly £1 fee if you want to invest your money. Pros: Helps you to save with little effort, also allows you to round up your spare change and earn interest on your savings.Ĭons: Have to pay to get some features that other apps offer for free, such as goal setting and cashback.

#APP FOR FINANCES AND DOMESTIC WORKS PRO#

Plum offers more than one plan and its premium options also offer the opportunity to invest your money as well as earn cashback, set savings goals and create saving spaces to separate your money.Ĭost: Plum Basic – free Plum Plus – £1 a month Plum Pro – £2.99 a month (free 30-day trial with both).

It lets you know if you could be overpaying on your regular bills and suggests ways to save money. Plum takes budgeting one step further and does the hard work for you as it uses artificial intelligence to automatically calculate an affordable amount to save based on your spending pattern. Plum uses AI to automatically calculate an affordable amount to save. There is no Financial Services Compensation Scheme protection for any money you hold on the prepaid account. Features such as rounding up your spare change and scheduled payments mean you can maximise your saving.Ĭons: Yolt does not allow for weekly paydays. Pros: Encourages you to set spending budgets. Once you have connected your accounts, Yolt allows you to track your spending, see upcoming transactions, create budgets and set saving goals. Yolt allows you to organise all of your accounts in one place and you can take things one step further by using its prepaid debit card for everyday spending. Desktop version also available.Ĭons: Takes time to set up and its automatic spending categorisation could be better. Pros: In-depth budgeting analysis with personalised categories based on your individual spending. The level of customisation in the app is ideal for those with accounts and investments across a range of providers. Money Dashboard also graphs your projected monthly spending with a predicted balance at the end of the month. These include customisable categories for your spending – for example, you may want to group together all payments for presents around Christmas – and the option to add accounts manually. Offers most of the same features as Emma Pro but at no cost. Cashback and rewards for spending with certain retailers such as the Body Shop, B&Q, Gousto, Boots and more.Ĭons: A bit gamified and the push to subscribe to Emma Pro can become annoying. Good for: Beginners and managing subscriptions.Ĭost: Emma – free Emma Pro – £59.99 a year, with the first seven days free.

0 kommentar(er)

0 kommentar(er)